Cryptocurrency has become a buzzword in the world of finance, and its popularity is increasing rapidly. Cryptocurrency is a digital asset that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin is the most popular cryptocurrency, but there are many others like Ethereum, Litecoin, and Ripple. In this article, we will cover the basics of cryptocurrency, its benefits, security, types, and the future of cryptocurrency.

How Cryptocurrency Works

Cryptocurrency uses a decentralized system, meaning it is not controlled by any single entity or government. Instead, it is managed by a peer-to-peer network of computers known as nodes. Each node has a copy of the blockchain, which is a public ledger that records all transactions. When a user initiates a transaction, it is broadcasted to the network, and the nodes verify the transaction’s authenticity. Once the transaction is verified, it is added to the blockchain and becomes irreversible.

One of the unique features of cryptocurrency is that it uses complex cryptography to secure its transactions. Each transaction is verified by a process called mining, where powerful computers solve complex mathematical problems to confirm the transaction. This process ensures that the transactions cannot be tampered with or reversed, making cryptocurrency a secure and reliable way to transfer funds.

Cryptocurrency Benefits

Cryptocurrency has several benefits that make it an attractive investment option for many people. One of the significant advantages of cryptocurrency is its decentralization, which means that it is not controlled by any central authority. This feature makes it immune to government intervention, making it a popular choice for people who value financial privacy.

Another significant benefit of cryptocurrency is that it offers fast and cheap transactions. Cryptocurrency transactions are processed quickly, and the fees are lower compared to traditional banking systems. This advantage makes it an excellent choice for businesses that need to transfer funds quickly and at a low cost.

Cryptocurrency is also becoming an increasingly popular investment vehicle. Many people see it as a hedge against inflation and a way to diversify their investment portfolios. As the demand for cryptocurrency continues to grow, its value is expected to increase.

Cryptocurrency Security

Cryptocurrency is a secure way to transfer funds, but it is not immune to fraud and hacking. There have been several high-profile cases of cryptocurrency exchanges being hacked, and investors losing their funds. To ensure the security of your cryptocurrency investments, it is essential to take the necessary precautions.

One way to secure your cryptocurrency is to store it in a hardware wallet. A hardware wallet is a physical device that stores your cryptocurrency offline, making it less vulnerable to hacking. Another way to secure your cryptocurrency is to use a reputable exchange platform like https://switchere.com/exchange/buy-bitcoin. These platforms use advanced security measures like two-factor authentication and SSL encryption to protect your funds.

Types of Cryptocurrency

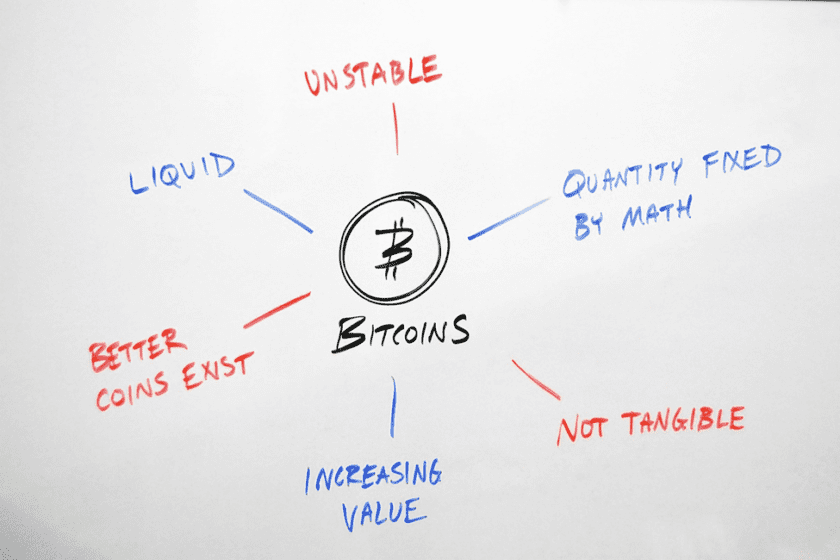

Bitcoin is the most popular cryptocurrency, but there are many others like Ethereum, Litecoin, and Ripple. Each cryptocurrency has its unique features and applications. For example, Ethereum is a blockchain platform that allows developers to build decentralized applications (dApps), while Ripple is a payment protocol that facilitates fast and cheap cross-border transactions.

As the demand for cryptocurrency grows, new types of cryptocurrency are emerging. Stablecoins are a type of cryptocurrency that is pegged to a stable asset like the US dollar. This feature makes them less volatile than other cryptocurrencies, making them an excellent option for people who want to avoid the risk of price fluctuations.

Conclusion

Cryptocurrency is a revolutionary technology that has the potential to transform the financial industry. Its decentralized nature, fast transactions, and lower fees make it an attractive investment option for many people. However, it is essential to take the necessary precautions to ensure the security of your cryptocurrency investments. By using reputable exchange platforms and hardware wallets, you can protect your funds from fraud and hacking.

If you are interested in investing in cryptocurrency, it is essential to do your research and understand the risks involved. Cryptocurrency is a high-risk investment, and its value can be volatile. However, as the demand for cryptocurrency continues to grow, its value is expected to increase, making it an excellent option for people who want to diversify their investment portfolios.