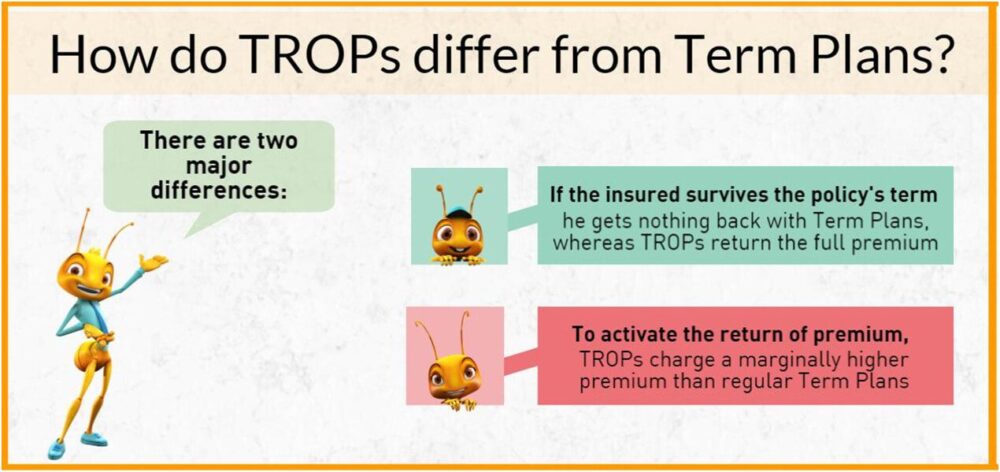

The TROP variant provides the same benefits as regular term insurance plans. However, here the policyholder is entitled to receive the total premium paid in case of survival.

Understanding TROP

Here is a quick guide to help you understand the features of this plan.

The objective of TROP is to meet the requirements of potential insurance buyers. It provides the dual benefits of high coverage and the return of the aggregate premium. Here is an illustration to give you a better idea.

Raj has a term life insurance of INR 1 crore for 30 years, and his approximate annual premium is around INR 8,000. In case of his demise during the plan’s tenure, the insurer is liable to pay the nominee a sum assured of INR 1 crore. However, if he outlives the policy’s tenure, the insurer will have to pay him INR 2.4 lakh (30 years x INR 8,000), as Raj has a TROP.

Features of TROP

Listed below are a few key highlights of TROP:

- Life insurance cover

Here, the life insurance cover refers to the sum assured as per the terms of the policy. In TROP, the sum assured is a bit low compared to the coverage offered by a standard term insurance plan.

- Survival benefit

In TROP, you can get a survival benefit on the plan’s maturity if you live past the tenure. This feature makes TROP different as compared to a traditional term insurance plan. Besides this, the maturity benefit that you receive is tax-exempt according to the Income Tax Act, 1961.

- Death benefit

If any case of any untoward incident, your nominee will receive the total sum assured.

- Riders

TROP offers the same riders (add-ons) as usual term life insurance policies. You can reap the benefits from add-ons, like accidental death, income benefit, waiver of premium, terminal illness, and disability rider, among others. However, you will not receive the amount that you pay for the rider if you survive the tenure.

- Paid-up value

This is one advantage due to which a TROP stands out. You can avail of this benefit only in case of a TROP and not a regular term insurance policy. Under this benefit, the insurer will not discontinue the policy even if you fail to pay the premium on time. To avail of such a benefit, you need to pay a premium of a few years together. The number of years varies among insurance providers.

Advantages of investing in TROP

Here are a few plus points in investing in TROP.

- A term plan does not return the premium if you live through the policy tenure. Whereas with TROP, you can get back the premium if you survive the policy duration. If you are one of those who consider term insurance as an expense, then this plan is ideal for you.

- The premium paid towards the policy and the death benefit that the nominee will receive are tax-free under Section 80C and Section 10(10D) of the Income Tax Act 1961

Do not jeopardize your family’s financial future. Remember that, as TROP comes with a maturity benefit, it has a higher premium compared to a regular term policy. Search for the best TROP using the term plan calculator, and invest in it today.