It’s a question of controversy how to classify Bitcoin exactly, how Bitcoin works. Is it an asset class or currency of a kind, a value store, a payment network? Thankfully, Bitcoin is easier to define. It is software. It is software. Don’t be fooled with shiny corners with modified Thai baht symbols with stock pictures. Bitcoin is a purely numerical, protocol- and process-oriented physique. Bitcoin has inspired hundreds of imitators but remains by capitalization the most significant cryptocurrency of its decade-long history. For more information, visit crypto comeback pro.

How to Buy Bitcoin

Despite being public, Bitcoin is complicated to manipulate, or rather, because of this. A bitcoin doesn’t have a physical presence so that you can’t keep it in a safe place or bury it in the forest.

The bad actor would have to account for 51 per cent of Bitcoin’s mining power to achieve double-spending. It would help if you had the confidence to prevent it from happening. The usual solution would be to trade through a central, neutral arbiter like a bank with the traditional currency. However, Bitcoin did not have to. The Bitcoin network is not centralized but instead has reliable authority to maintain the leader and preside over the web. Everybody looks at all the others.

The Blockchain Technology

In a 2008 paper by a person or people who first called themselves Satoshi Nakamoto, Blockchain and Bitcoin described both terms for a while, but both were synonymous. The terminology can be confusing in this history. The technology is referred to be Blockchain in general or any other blockchain, such as Ethereum. Blockchain technology’s basics are graciously straightforward. In theory, for any two parties, an agreement opens up a world where loans or decentralized savings and checking accounts, including peer-to-peer financial products, are irrelevant to the banks or any intermediary.

Although Bitcoin’s current objective is a payment system and a value store, there is nothing that says that Bitcoin can’t be used in the future, even though there is a consensus that bitcoin should add such systems to Bitcoin. The main objective of the Ethereum project is to create a platform where these “intelligent contracts” can occur and thus create a whole range of decentralized financial products with no intermediaries and the associated fees and data breaks.

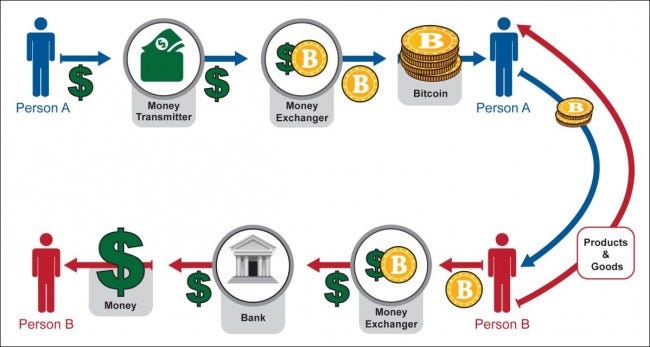

This versatility has captured the minds of governments and private companies, and some analysts believe that the most impactful aspect of the cryptocurrency craze will eventually come from blockchain technologies. However, in the case of Bitcoin, most transactions are information about the Blockchain. Bitcoin is indeed a list. Person A has sent X to B, who has sent Y to C, etc. Everyone knows where individual users check these transactions—noted that humans must not make these transactions from human to human.

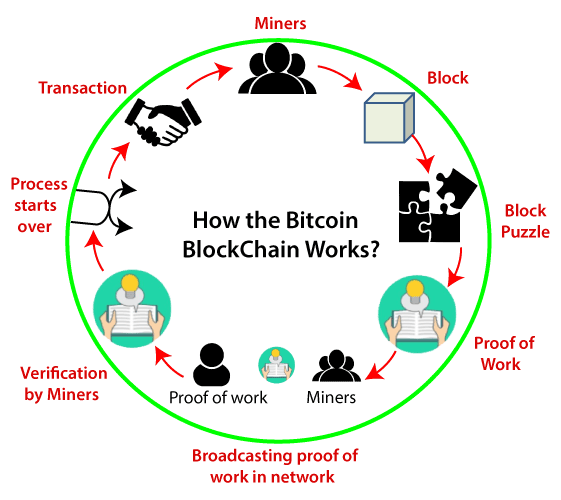

Bitcoin is a distributed Blockchain, meaning it’s public. The record of bitcoin is shared, but updating the blockchain ledger is complicated. There is no central authority to record any Bitcoin transactions so that participants create and monitor the ‘blocks’ for transaction information themselves.

Mining

Mining is the process by which this decentralized public ledger is maintained. Mining is done with highly advanced computers which solve extremely complex computer math problems. Nonetheless, for many investors interested in cryptocurrency, mining has a magnetic appeal because miners receive cryptocurrency tokens for their work.

And why not if you’re tilt-in technologically? It could be because businesses see mining as centigrades from the sky, such as gold prospectors in California in 1849. We will focus mainly on bitcoin (in all respects, when referred to as the network or cryptocurrency, we will use “bitcoin” as a concept and “bitcoin” when referring to several single tokens). While recording a series of transactions is trivial for a modern computer, mining is difficult due to how Bitcoin’s software artificially slows the process

Halving

Each 210,000 or all four years, half of this award is cut. Halving or halving is this event. The mechanism is integrated with the rate of release of new Bitcoin as a deflationary system. This approach is intended to maintain Bitcoin mining benefits until roughly 2140. Once all Bitcoins are mined, miners are incentivized to charge network users with costs when all halves are completed. The healthy competition hopes that fees will remain low. This system enhances the Bitcoin inventory-to-flow ratio and reduces inflation to zero.