Over the ages that have come to light from the time when currency, first came into use, the manner, in which the Indians use money has endured numerous conversions. Demonetisation has shown, over a year that’s how there has been a push in the direction of a digital economy, however the love for cash declines to fade away. Going from ‘cowrie’ shells and gold coins to paper banknotes and the contemporary digital ways and means — the account of expenses in India is wide-ranging and interesting. As the RBI (Reserve bank of India) bowls out the Rs 50 as well as Rs 200 values in the Indian currency system, one can trace the development of it from the initial days of chronicled history.

Initial currencies:

Abundantly found in the Indian Ocean, the cowrie shells, were colloquially referred to as ‘Kauri’. They were used in some areas, in and around Odisha, even until the initial 1800’s. The 6th and 7th century BC was found to be documenting the first instance of coins, which were used as currencies. The coins were ‘punch marked’ in stamped metal bars (generally silver and copper) and were primarily issued in the ‘Mahajanapada’ kingdom during the Iron Age of the then India. They lasted till the end of the Imperial Mauryan period.

For many centuries to come, new sorts of coins which were introduced by the Indo-Greek kings, which influenced Indian coinage for many periods to come. From 1st to 3rd centuries CE, the Kushan Empire existing at that time started minting gold coins, featuring mythological deities. Later, during 320-470 CE, the Gupta Empire produced the maximum number of gold coins in the Indian history, and that is the reason why it is often referred to as the ‘golden period’. Entirely through the subsequent dynasties in India, coins continued to contract on diverse phases – from the Maratha and Vijaynagara kingdoms in the South to the Rajput and Mughal Empires.

During the five year rule from 1540-45, Sher Shah Suri introduced to the nation-state a new currency, which was the antecedent of the modern day Rupee. Suri set up a new civic and military administration issuing the ‘Rupiya’, which remained in circulation even during the remainder of the Mughal Period as well as during the Maratha era, much after defeating Humayun and taking over the Mughal Empire in 1540. Even during the British Raj, the ‘Rupiya’ remained the dominant standard currency, despite the East India Company’s efforts to introduce the Sterling Pound in India as early as the 1600’s. In both design and metrology, the coins issued in Western India (Bombay and Surat) and South India (Madras) provinces, differed from their northern counterparts.

Ancient origins: Cowrie shells (top) were the leading sorts of currency used in India, before being substituted by silver and gold coins, such as these ones from the Maurya Empire (bottom)

Only in the early 19th century, when the English, who were then the dominant power in the country, legislated the Coinage Act of 1835, the issuance of a uniform coinage in India was brought about. From 1840 onwards, the freshly designed coins witnessed the traditional Indian images and symbols replaced by the effigy of King William IV, which later got replaced by the portrait of Queen Victoria. But then, the British declared the Rupee as the official currency of colonial India, only after the Indian Rebellion of 1857 (Sepoy Mutiny).

Once currency was crowned the ruler:

The precious metal used for minting aided to the valuation of coins. The sovereigns started having problems as they did not possess the requisite gold or silver for preventing a drastic devaluation of money. Paper money, hence resolved this issue, as it bore an assurance to recompense its owners the equal value of gold or silver, from the communal reserves. The paper money was not backed by anything of real value, and it was just accepted as a medium of exchange for goods and services.

It no longer really mattered of the fact of paper money being backed by anything of real value. It got simply accepted as a medium of exchange for the goods and services. Though paper currency was popularized by Genghis Khan in Asia, as early as 11 century, it only gained the power in India after a few centuries.

The silver and gold coins gave way to ‘hundis’, shares and bonds, in the late 18th century, when the paper currency was initially introduced in India. The Bank of Hindustan (1770-1832) and The General Bank of Bengal and Bihar (1773-75), were amongst the initial issuers of paper currency in India. Together, the private and semi-government ‘Presidency-banks’ printed notes. Consequently, the ‘Victoria Portrait Series’ of currencies— in values of Rs. 10, 20, 50, 100, and 1,000 — came in the flow.

The ‘Swadeshi’ Movement, made a big impact on Indian banking, while the Indian Independence Movement soon began gathering steam along with its nationalist and economic strategy arm. Several Local banks like, Canara Bank, Bank of India, Corporation Bank, Indian Bank and Bank of Baroda, to name a few — for the Indian community from 1906 to 1911, were founded by businessmen and politicians after getting inspired by the message of reviving domestic processes and products .

Due to the outbreak of World War I in 1914, the British Empire faced an acute shortage of silver and therefore began issuing paper currency of smaller denominations (one and two Rupees), hitherto dispensed simply as loose changes or coins. In the meantime, India got its first printing press in Nashik in 1928, which shortly started printing currency for the whole nation.

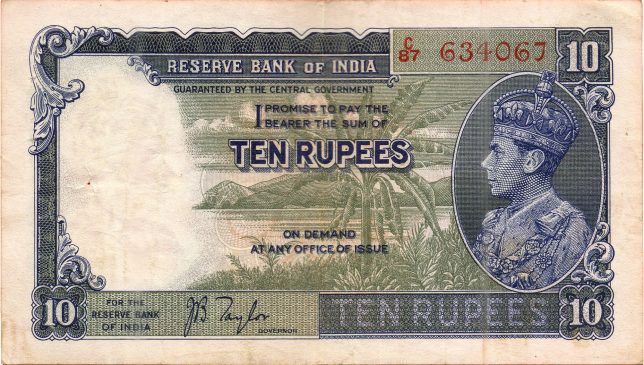

Under British rule, the rupee endured quite a few reiterations,including this ten rupee note from the 1920’s (top) and this one rupee coin from 1918 (bottom).

The need for an apex monetary authority was identified, and the First World War left the Indian economy in dire straits. The Reserve bank of India (RBI) was set up, in order to separate the control of currency and credit from the government and to regulate banking and note issuance throughout the country. The Central Legislative Assembly, following the rules, as mentioned by the 1926 Royal Commission of Indian Currency and Finance, took the initiative.

The RBI was officially initiated on April 1, 1935, through its Central Office in Calcutta (currently Kolkata) which was repositioned to Bombay (currently Mumbai) in 1937. Later, after a year, the top bank dispensed its initial sequence of notes, nowadays having a photograph of the new British monarch — George VI. The Rupee Five notes were the initial one to be dispensed in this sequence and Rs. 1, 2, besides 10,000 notes were consequently added-on to the pre-existent moneys.

The portrait of George VI on the Rupee note was replaced by an image of the Ashoka Pillar, when the Republic of India was established on January 26, 1950. Until The High Denomination Bank Notes (Demonetisation) Act, 1978, this currency remained in circulation unchanged. The use of high-denomination bank notes of Rs. 1,000, 5,000, and 10,000 which were undermining the Indian economy due to their use in illegal financial transactions, following this law was halted by the Indian Parliament.

The first notes bearing the picture of Mahatma Gandhi were printed, in 1996. These notes, remain in circulation even today featuring the upgraded security measures and tangible aids for the visually impaired, with the exception of the Rs 500 and Rs 1,000 notes which were replaced after the Demonetisation in 2016.

The present banking system took birth:

The country’s economy got decimated and paralysed banking activities for months, when the partition of India took place after independence. The government sought to create a mixed economy as opposed to the system of ‘laissez-faire’, being keen on to restore the economic welfare in India. The RBI got nationalised with effect from January 1, 1949, while coming under the Reserve Bank of India (Transfer of Public Ownership) Act, 1948. Within a few months’ time, the 1949 ban regulation Act was passed empowering the RBI to control, regulate and inspect the Indian banks. This law, for the first time got ultimately revised in 1965 in order to place the cooperative banks under the preview of the RBI.

By the 1960’s, the Indian banking industry played a key role in augmenting the country’s economy and was a large employer. The then Prime Minister Indira Gandhi, decided to municipalise the bank-industry, since the banks in India were owned by private entities. The Parliament nationalised 14 of the country’s largest commercial banks with effect from July 19, 1969 and passed the Banking Companies (Acquisition and Transfer of Undertakings) Bill. The government further nationalised six most commercial banks, in 1980 after which it controlled around 91 percent of the Indian banking industry.

A decade later the Indian banking sector underwent yet another upheaval. In 1991, after facing a huge economic crisis, in large part due to the Gulf War and USSR collapse, liberalisation policies that allowed the entry of private banks into the country, got introduced by India. A new era for the Indian banking sector was welcomed by the private banks like, HSBC Bank, ICICI Bank, HDFC Bank, and UTI Bank (now Axis Bank). In Mumbai, the Automated Teller Machine (ATM) in India was set up initially by HSBC bank, around 1987. And, the trend of ATMs started getting popular in and around India, with the concept of ‘plastic money’ (in forms of credit and debit cards) getting prominent.

In 1988, the Indian Banking industry experienced the onset of computerisation, followed by Internet Banking in the 1990’s. National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), Electronic Funds Transfer (EFT), and Inter bank Mobile Payment System (IMPS) were widely held amongst the common people, in the 2000’s, thus making the online payment system quite prevalent.

Onset of Digital Expense:

The new wave of e-payments brought about by digital wallets has made transferring money a lot easier and quicker, when NEFT and other forms of online payment had the requirement of a computer and often featuring lengthy transaction. E-wallets like Google pay, PayTm, PayU and MobiKwik have become more user-friendly, courtesy the smartphones, for millions related to the financial dealings, together private and commercial.

After the demonetisation drive by the Narendra Modi led government, India witnessed a steep rise in the ‘cashless dealings’, with mobile wallet dealings recording a massive rise. The digital expense in India rose up by 23 percent (approx.) as per records in November and December 2016. A Google study besides foresees that the Indian digital expenses’ industry will be growing to Rs 500 billion by 2020, showing a 15 percent of the GDP.

Contrasting to the digital expenses, which depend on a stable internet connection besides approval from together purchaser and vendor, cash is immediately obtainable for additional offline dealings. That is the method of payment for Indians at present. This will change, once the digital set-up in the country is upgraded to the level that all Indians, irrespective of urban or rural, can make digital payments as effortlessly as they do with cash.

Digital expenses itself is on the rise with the launch of crypto currency. As they are a spread out and very much a secure form of money, currencies like Bitcoin, Ethereum as well as Monero are getting popular around the world. Though it might take some time for them to be recognised as an official currency by the governments of the world, they are definitely the following stage in this extensive growth of payments.