Not every other person can become an entrepreneur, but if you make a good business plan, no one can stop you from that. Making an apt plan for a successful business comes in the strategic tools. Why? It is a strategic tool because when you are making a plan to invest in something, you want to know an estimate of the profit and losses.

And, without looking for all the eventualities, your unique plan can directly face some significant shortcomings. To ensure all the aspects, you must know the essentials to make a full-proof plan for growing your business. So, let’s start from the basics of this most important strategic tool.

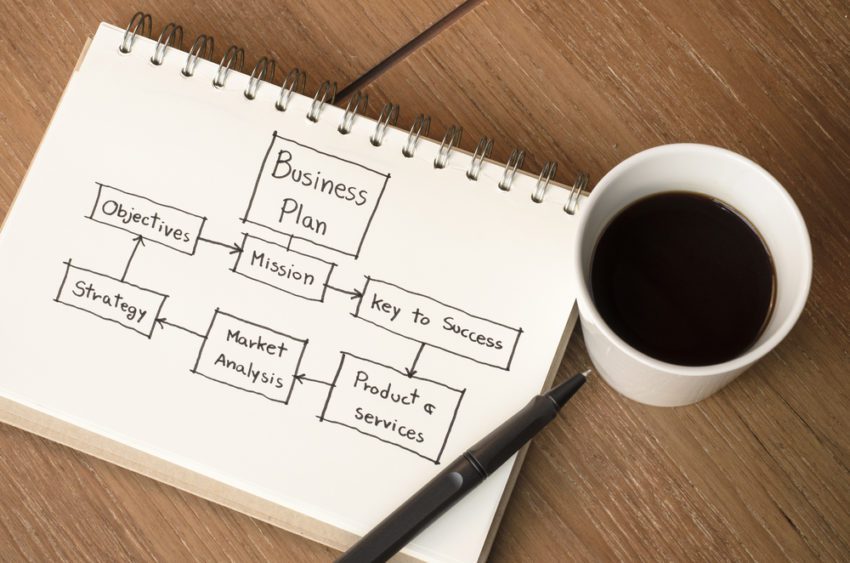

What is a Business Plan?

Creating a start-up takes a good brain, good investment, and intelligent plans. A smart strategy is when you make a plan with settings; your goals should be clear, and your investment plans. A plan not only helps the entrepreneur on focusing their need in the right direction but also helps to succeed with keeping the eventualities in mind.

When you plan well, your results are well. Unfortunately, many people start their business without making a business plan because they think it is not a necessary need. But, if you want to succeed, a wise man/woman will always know how important planning could be for them.

If you think this is just a hoax without any particular research. It was found in a survey that more than 60% of business models are up to the mark but due to the lack of planning. So, all the money goes in vain, and the business only results in a house of cards.

What Are the Tips to Keep Your Plan of Action in Business Perfect?

1. Keep A Clear View of Goals

While planning, you must clarify where you want to invest and how much you are to going to separate for the emergency funds. Investing all of your hard-earned money without thinking about the objective of the business is not a good plan. Your focus should remain on a single goal, don’t try to do everything at once.

2. Practicality Of Your Business Plan

You might have a great idea but check if it is feasible for you or not. Write it down on pen and paper and see if the business idea is worth it or not. If you have written your plans, then see what will be the following steps to grow it, save it from any loss, return from the business and most importantly, check the need for capital.

3. Check The Eventualities

Starting a startup will always have both sides of the coin. But you must ensure what will be your backup plan. Your business can be touching the sky, but what if something adverse happens? You should keep an eye over the contingencies too. Failure teaches you to become better. But, if you are smart enough, you can save yourself from significant losses by keeping a back plan to handle the situation.

4. Implement Your Learnings Periodically

After starting your business, remember there is always room for improvement. But, how? Be your teacher; learn from your shortcomings. Don’t just stick with your first version of the plan; keep evaluating your business; with experience, you will learn lessons. So, implement those lessons to outgrow from yourself, keep an eye on the market’s updated requirements, and change accordingly.

5. Don’t Waste Time on Unnecessary Things

Invest and think wisely before spending all of your capital. See, the long-term benefit of doing anything. Take a fair idea about your assets and liabilities, don’t sit and waste your time on trivial risks. A startup is a long journey, and to achieve success, you need to manage your time.

6. Always Evaluate Your Competitors

Before directly starting, evaluate the competitor in your market. Don’t take them for granted, instead see how they work if they are gaining profits. And learn how they have coped up in their losses. A fair idea of your competitors will help you excel in the market. Your evaluation can also help you in making profits in business.

7. Don’t Make False Claims

Plan your work and claim proofs already. When you are marketing your products or your services, make sure your promises don’t sound mundane. Keep up with your words. Don’t promise something you won’t be able to do; it can put your goodwill in danger. And, when the business falls out of its promises, the customers tend to run away.

These plans might look very simple, and you can think of avoiding them. But, remember, not everything that looks simple is always simple. These are the tiniest things people miss while coming close to failures or occurring huge losses.

Some setbacks can be handled, but a vast failure can be devastating as well. So, why not plan it before taking the major risking factors. If you have a fair idea about the contingencies of your plan, there is nothing terrible in it.

Be careful not to ignore the tips and choose a wise method to stay flexible. Business planning can act as a saviour in the market. If you plan to keep these tips in mind, you can save yourself from the pitfalls and potential risk factors while trading smartly. Also, planning can be the safest option to reduce stress before entering the market.